Research, content design (Itaú Design Language), design system (Itaú Design System), data, legal, customer support, and credit analysis.

Overview

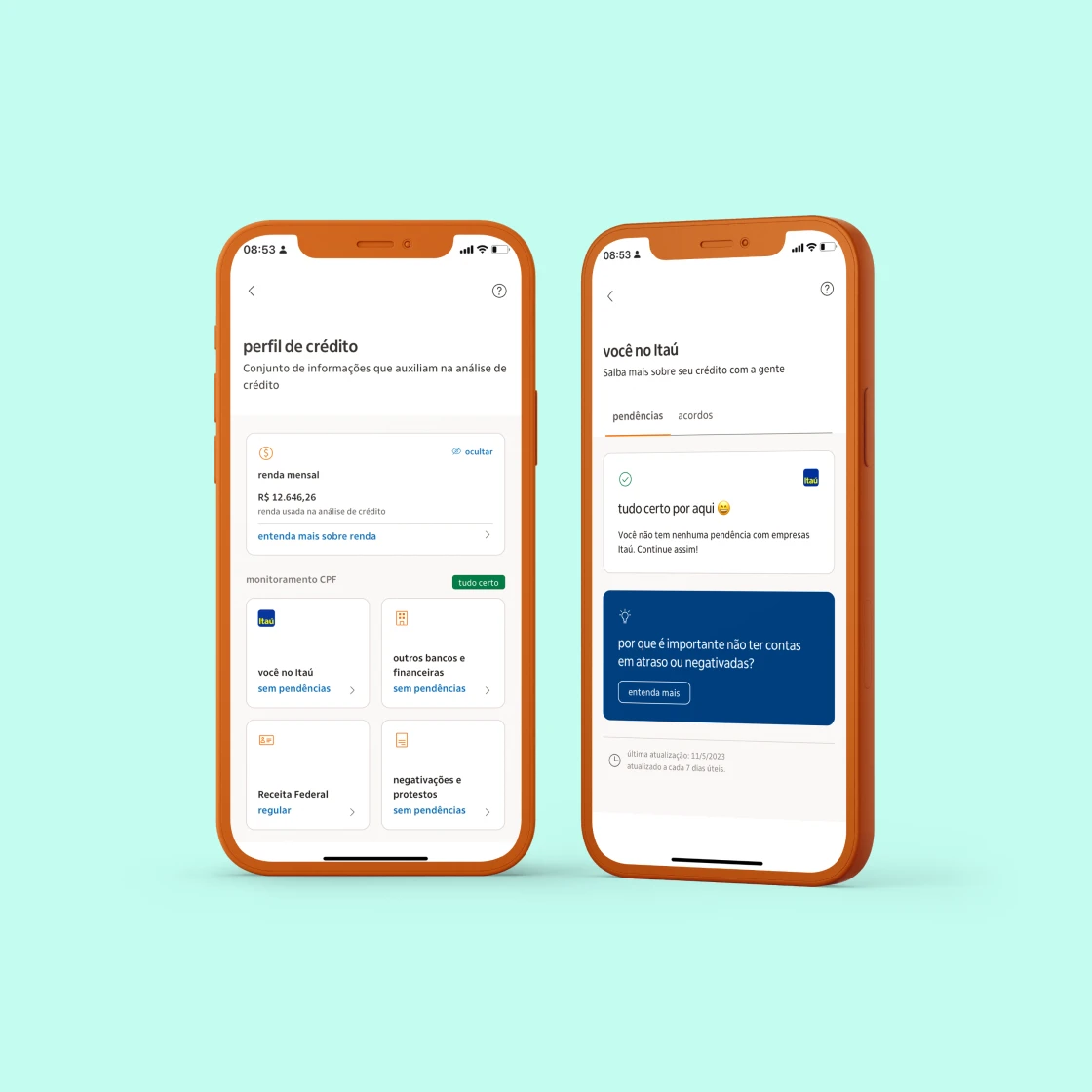

The project aimed to improve Itaú’s credit approval system by adding the “Perfil de Crédito” tool to the Itaú app. This tool gives users an in-depth view of their credit profile, including their CPF status, updates from Receita Federal, outstanding debts reported by credit bureaus, and the ability to adjust their monthly income.

With personalized insights and actionable recommendations, this tool helps users navigate their credit applications, ultimately boosting their chances of getting approved. It simplifies the process by highlighting problems that need to be fixed for future credit approvals.

Starter problems

Outdated Income Information

Income is one of the most important factors for credit approval, but it’s often outdated. Many people don’t know how crucial it is to keep this information up-to-date or aren’t informed about it.

Lack of Transparency in Credit Denials

A lot of people feel lost when their credit application is denied, and unfortunately, legal limits mean we can’t always provide a full explanation. Even when we do, it’s often not easy to understand.

Credit Info in Different Places

The credit process uses information from a lot of places, but with everything spread across different sites and apps, it’s hard for users to keep up. Most don’t know where to start.

* All the information comes from past research, data reports, user feedback, and prior experience.

Research & Discovery

The next steps were to begin research using data reports, user feedback, and past experiences.

Stakeholder Kickoff

Talking to stakeholders and teams such as Credit, SAC, Legal, and Data was key to figuring out their needs and the way the credit approval process is currently running.

Understand the Credit Approval Method

What information is important for credit approval?

Why is income information important?

What information could we include in the new feature to help users better understand why certain details are key for credit approval?

User Interviews

Conducted interviews with users to understand their motivations for seeking credit and to gather their opinions on the features presented in a low-fidelity prototype.

Stakeholder Check-Ins

Collaborated with stakeholders and different teams to understand their requirements and ensure alignment on project objectives.

Insights from Previous Projects and Research

Reviewed past and similar projects to understand their challenges, successes, research, and workflows, which helped shape the development of the new tool.

Benchmarking and Analysis

Analyzed the current credit procedures and user experiences to identify areas that could be enhanced and opportunities for new ideas.

Design & Development

Developed low, medium, and high-fidelity prototypes to collect valuable user feedback.

Design consistency

Collaborated closely with the IDS Team (Itaú Design System) and IDL Team (Itaú Design Language). The IDL team follows guidelines that favor lowercase words, using uppercase only when necessary.

Usability Test: Multiple Rounds of Testing

We reviewed the current credit procedures and user interactions to identify areas for improvement and explore new opportunities. This analysis led to the creation of an initial low-fidelity prototype for testing and gathering user feedback. With each round of testing, we uncovered new insights that helped us make adjustments and enhancements, ensuring the final version would meet user needs.

High-Fidelity Prototype Testing

Conducted in-depth usability testing on the high-fidelity prototype to confirm everything was working perfectly before heading into the final design phase.

Documentation & Handoff

Compiled thorough documentation of the interfaces and workflows to guarantee a smooth transition for the technology and product teams throughout the implementation process.

The IDL (Itaú Design Language) uses a has with rule use as many lowercase words and in specific cases uppercase words.

Check out more about the IDL

Prototype video

Expected Results

Even though I wasn’t at Itaú anymore, we had set clear expectations for the results with the team, managers, and directors.